reviewing our policies on risk assessment and risk management;

reviewing, with our independent registered public accounting firm, our internal quality control procedures, any material issues with such procedures and any steps taken to deal with such issues; and

pre-approving audit and permissible non-audit services to be performed by the independent registered public accounting firm.

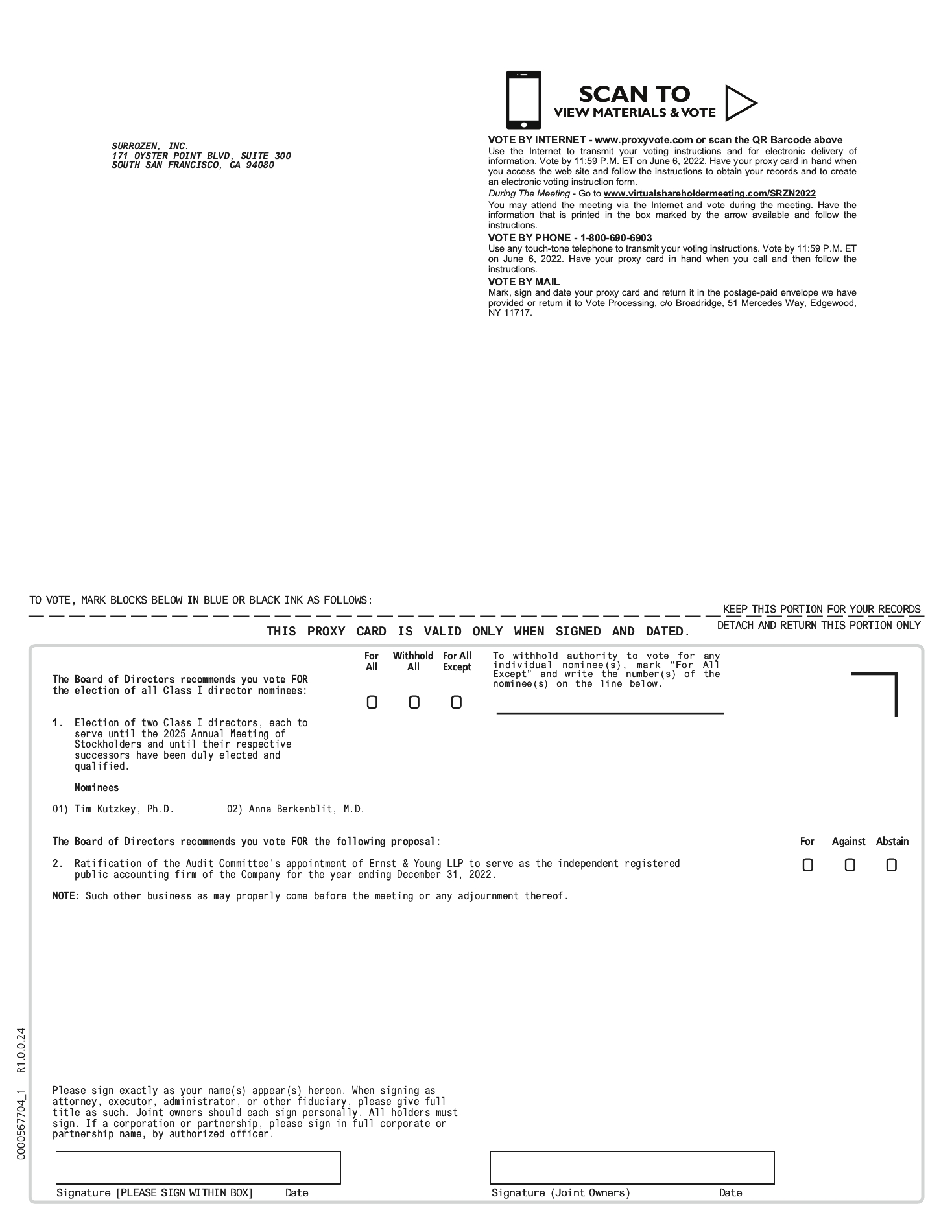

The Board of Directors has | | | | | | | | |

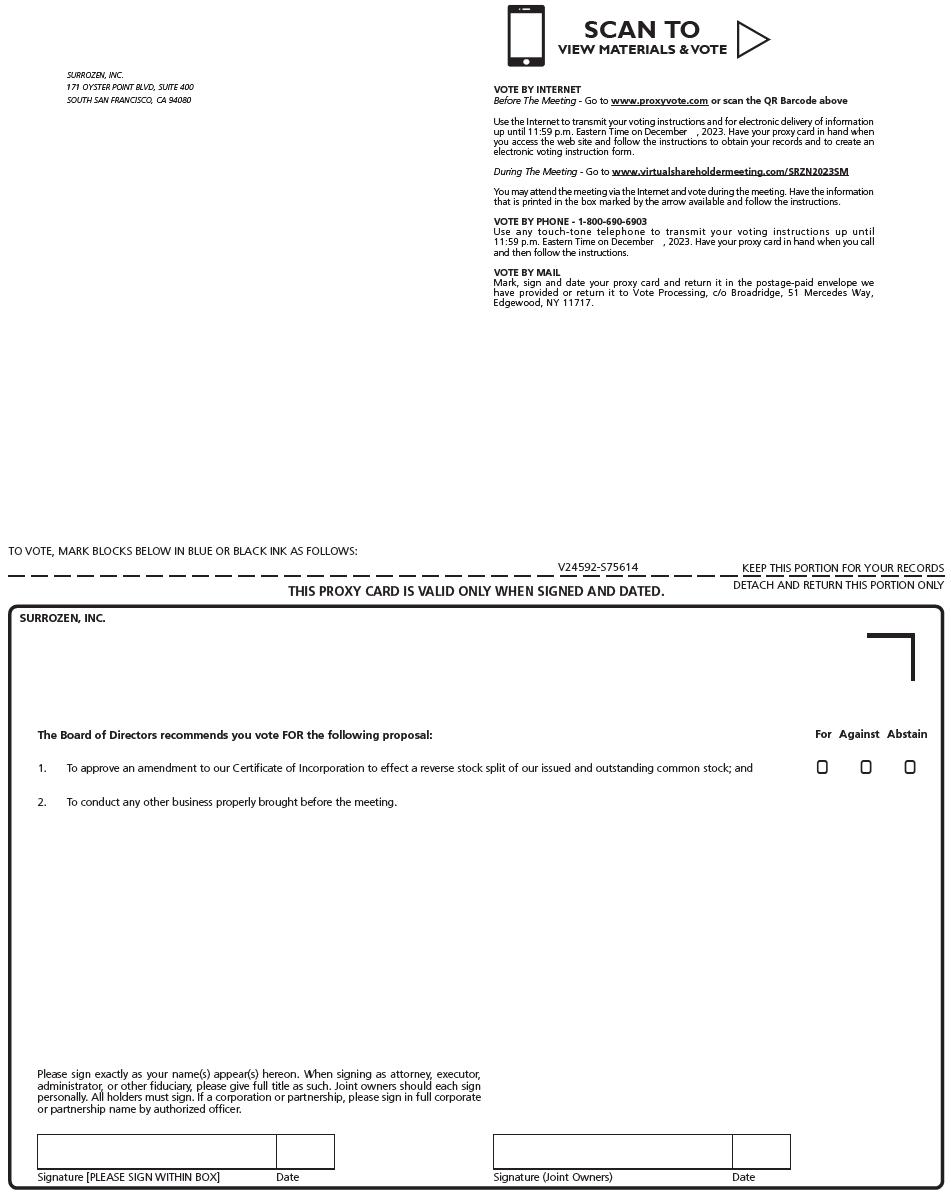

| | After Reverse Stock Split | |

Ratio of

Reverse Stock Split | | Approximate Shares of

Common Stock

Outstanding | | | Authorized

Shares of

Common Stock | |

None | | | 30,575,047 | | | | 500,000,000 | |

1:10 | | | 3,057,504 | | | | 500,000,000 | |

1:11 | | | 2,779,549 | | | | 500,000,000 | |

1:12 | | | 2,547,920 | | | | 500,000,000 | |

1:13 | | | 2,351,926 | | | | 500,000,000 | |

1:14 | | | 2,183,931 | | | | 500,000,000 | |

1:15 | | | 2,038,336 | | | | 500,000,000 | |

1:16 | | | 1,910,940 | | | | 500,000,000 | |

1:17 | | | 1,798,532 | | | | 500,000,000 | |

1:18 | | | 1,698,613 | | | | 500,000,000 | |

1:19 | | | 1,609,213 | | | | 500,000,000 | |

1:20 | | | 1,528,752 | | | | 500,000,000 | |

1:21 | | | 1,455,954 | | | | 500,000,000 | |

1:22 | | | 1,389,774 | | | | 500,000,000 | |

1:23 | | | 1,329,349 | | | | 500,000,000 | |

1:24 | | | 1,273,960 | | | | 500,000,000 | |

1:25 | | | 1,223,001 | | | | 500,000,000 | |

1:26 | | | 1,175,963 | | | | 500,000,000 | |

1:27 | | | 1,132,409 | | | | 500,000,000 | |

1:28 | | | 1,091,965 | | | | 500,000,000 | |

1:29 | | | 1,054,311 | | | | 500,000,000 | |

1:30 | | | 1,019,168 | | | | 500,000,000 | |

If a compensation committee, which consists of the following members: Mary Haak-Frendscho, Ph.D., Anna Berkenblit, M.D. and Shao-Lee Lin, M.D., Ph.D. The chair of our compensation committee is Mary Haak-Frendscho, Ph.D. Our Board of Directors has determined that each member of the compensation committee satisfies the independence requirements under the listing standards of Nasdaq and is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act.

The primary purpose of our compensation committee is to discharge the responsibilities of our Board of Directors in overseeing our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate.

Specific responsibilities of our compensation committee include:

reviewing and recommending to our Board of Directors the compensation of our chief executive officer and other executive officers;

reviewing and recommending to our Board of Directors the compensation of our directors;

administering our equity incentive plans and other benefit programs;

reviewing, adopting, amending and terminating incentive compensation and equity plans, severance agreements, profit sharing plans, bonus plans, change-of-control protections and any other compensatory arrangements for our executive officers and other senior management; and

reviewing and establishing general policies relating to compensation and benefits of our employees, including our overall compensation philosophy.

Our compensation committee operates under a written charter that satisfies the applicable listing standards of Nasdaq.

The compensation committee generally considers the Chief Executive Officer’s recommendations when making decisions regarding the compensation of non-employee directors and executive officers (other than the Chief Executive Officer). In addition, the compensation committee has created s subcommittee, the Equity Award Committee, and has appointed Mr. Parker, our Chief Executive Officer and director, as the sole member of the subcommittee. The Equity Award Committee is responsible for reviewing and approving equity awards, subject to certain grant size and position level limitations. The Equity Award Committee may only grant awards to new hires and those who hold a position below the level of Vice President. No individual grantee may receive awards from the Equity Award Committee covering more than 25,000stockholder owns 10,000 shares of our common stock per calendar year.

Pursuantprior to the compensation committee’s charter,Reverse Stock Split, after the compensation committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors to assist in carrying out its responsibilities. Before selecting any such consultant, counsel or advisor, the compensation committee reviews and considers the independence of such consultant, counsel or advisor in accordance with applicable Nasdaq rules. We must provide appropriate funding for the payment of reasonable compensation to any advisor retained by the compensation committee.

Compensation Consultants

The compensation committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the compensation committee has engaged the services of AON as an outside compensation consultant.

As requested by the compensation committee, in 2021, AON’s services to the compensation committee included, assisting us in developing our peer group composition, analyzing benchmarking data with respect to our